Isle of Man Aiming to Become Global Leader in the Bitcoin Sector

Bitcoin, the electronic form of currency that started appearing in headlines a couple of years ago, is slowly becoming more widely accepted. Now, it’s possible to pay for certain products and services online using bitcoin, which is sourced through a process called mining using a computer. Although online retailers and even some online casinos have become open to the idea of accepting Bitcoin, brick and mortar retailers have for the most part not caught onto the cryptocurrency craze yet…in most places.

Aiming For Global Bitcoin Leadership

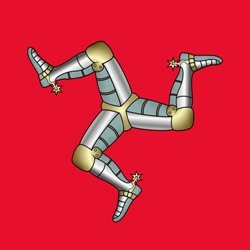

The Isle of Man located off the coast of the UK is an exception, and is seeking to become a global leader in Bitcoin exchange. In recent years, more than 25 startups have launched that accept Bitcoin as payment on the self-governing British Crown dependency, earning the island the nickname “Bitcoin Island.” In an effort to protect consumers, the Isle of Man has passed legislation that requires all businesses that accept Bitcoin to register with the government. This allows for their operations to be regulated and monitored. As Brian Donegan, head of the Isle of Man’s Department of Economic Development, explained to The Independent:

“We have an advantage here in that we can put the legislation in place and provide the rigorous oversight that is needed more rapidly than other jurisdictions. We move quickly because we can see the potential of what is out there. This technology is transformational and we want to be in the lead.”

Low Tax Rates

The Isle of Man has become an attractive destination for online gambling companys. Starting at the end of the 1990s, when online poker and other forms of iGaming were brand new, the Manx government was open to allowing providers to operate within its borders and has remained iGaming friendly ever since. Today, electronic gambling brings in about 16.7 percent of the British crown dependency’s £4.1 billion annual gross domestic product.

Part of the appeal for online gambling companies in the Isle of Man is that the country has managed to keep tax rates low for operators, as well as for other businesses operating on the island. Across all industries, the economy of the Isle of Man has grown 300 percent faster than the UK economy over the last three decades, and the government hopes that being at the forefront of the Bitcoin explosion will boost the economy even more.

Bitcoin Could Revolutionize Industry

Because of the prominent position held by online gambling in the Isle of Man economy, there is a possibility that the Bitcoin-friendly policies of other businesses operating on the island may carry over to websites. Bitcoin acceptance is an exciting proposition for online gamblers, as it provides a safe, instant way to place wagers, collect winnings and exchange currency with other players. Because Bitcoin can be instantly transferred between consumers, and consumers and businesses anywhere in the world, it can truly revolutionize the way people pay for goods and services.

A Few Drawbacks

For all the potential positives of the expansion of Bitcoin acceptance, there are some problems associated with the currency. Bitcoin transfers do not reveal the identity of the payer or the payee, making the cryptocurrency appealing to those looking to fund illegal activities or purchase illegal merchandise online. “Dark web” websites, such as Silk Road, for instance, relied upon cryptocurrencies to funds its business, which included such illicit contraband as weapons, narcotics, stolen credit cards, and fake products. The site has since been shut down by the FBI with its creator Ross Ulbricht now serving a life sentence behind bars.

Proponents of Bitcoin, however, argue that the dark side of the currency is grossly exaggerated by the mainstream financial services industry that currently controls monetary transaction processing. In fact, there are now signs that many banks may be shifting their previous view of bitcoin as an enemy, to one embracing a new mainstream digital currency revolution. Commenting on the issue, Charlie Woolnough, founder of ‘CoinCorner’, and ‘Manx Digital Currency Association,’ stated:

“Two years ago, banks were either horrified or largely unaware of cryptocurrency. Now they are waking up to the idea that it has some merits.”